Tips for Buying a Home (cont -page 2)

Helping your RealtorŪ sift through the thousands of opportunities will also help you. You don't want to waste time inspecting a dog while the home of your dreams is purchased by someone else.

Talk it over with your family. Decide what features are absolute requirements and which are mere niceties. Commit the list to writing, listing them in order of priority. This will help your RealtorŪ more easily identify which properties suit you and which do not.

You can also help yourself by looking for your new home online. Click on the Find a Property button and it will take you to a page that will allow you to run your own search in the privacy of your own computer. Surf at your own speed. Look at the pictures and read about the properties.

Examine the descriptions for key words that will either turn you off or turn you on. While handymen love the chance to save money and do it their own way, those without a toolbox may elect to buy it the way they want it.

If you see one you like, write down the address or MLS number and email it to your RealtorŪ. They can respond, letting you know whether or not the house is located in the kind of neighborhood you are seeking.

Look slightly above and slightly below the price tag you think you can afford. Asking price is not always the selling price and sometimes good properties are undervalued by agent or sellers who don't know any better. That said, don't assume you will be able to get a property at a significant discount, cash buyer or not. In a tough market, properties are generally priced very close to the price it will take to sell. Be concerned with the true value instead and ask your RealtorŪ for a CMA on the home you have selected if you are concerned about the amount you should offer.

You will always be faced with a decision to buy a property in move-in condition or one that needs a little help. You can save major bucks with a little elbow grease and imagination, but you will have to write a check for materials and labor you are unable to provide. That comes out of your pocket, where improvements already done are included in your purchase loan. Don't think you are going to do the work without a toolbox. You probably already have a fulltime job. Be careful about planning projects you may never get around to finishing.

Is the Lowest Priced Home the Best Deal?

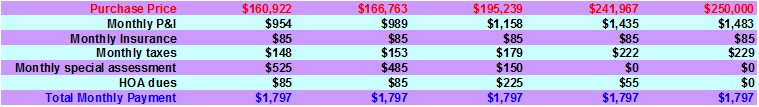

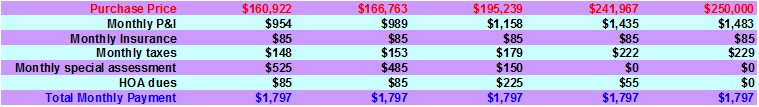

Though it may seem intuitive that the lowest priced home in any given area is teh best deal, that is not always the case. The price of the home matters less than the monthly payment which is what your lender will consider when qualifying you for a loan. Look at the chart below which indicates how HOA and taxes can impact your purchase.

So which do you think is the best deal? Remember, taxes seldom go away and HOA dues will always rise on homes older than two years. However, ask about Mello Roos, and special assessments. They generally have a limited life, 25-30 years. What if taxes are arbitrarily high due to a special assessment due to terminate in two years. You will only have to bite the bullet for 24 more months before receding to a more modest tax base. Many special assessments started in 1993, almost 15 years ago. It is always worth looking into.

New Home

Buying a new home, like buying a new car, is exciting. You can be the first one to "lick the doorknob" making it yours before anyone else has the chance to spoil it. If early enough in the process you can pick your own flooring, appliances, interior upgrades, even landscaping.

However, use caution. The house that looks like such a good deal when you look at the price list may not look so good when you add lot premium, flooring, countertops, etc.

Builder installation of all upgrades is usually more expensive than if contracted elsewhere. It has to be. They tack on their profit. The builder grade in most new homes is predictably low in quality. They want you to upgrade. Profit increases when you do. Nothing wrong with that, you just need to be aware that is the game. However, the benefit to having the builder put in improvements is that they often can be included in your loan. No cash out of pocket to you.

Contrary to popular opinion TAKE YOUR REALTOR WITH YOU! Most builders will pay compensation to your REALTORŪ which means your REALTOR® can and should represent you. If the builder doesn't pay compensation, they don't want you to be represented. Builders do this for a living and like innocent buyers who don't know what to ask for. An agent will help negotiate your purchase. Experienced agents know what concessions builders are willing to give and what builders are willing to pay for. Don't miss out on a potential freebe.

Standard Sale

A transaction in which a private property owner voluntarily lists their property for sale and there is enough money to pay closing costs, all loans, liens and commissions. IT COSTS A BUYER NOTHING TO BE REPRESENTED BY AN AGENT. The seller pays the commission on both sides so there is no cost to a buyer. The purchase of a home is complex. You will need help selecting a home inspector, going over the paperwork, knowing what repairs to ask for, and assuring that the disclosures are complete and accurate. Unless you do this for a living, you need help.

Despite what you may have heard from your favorite uncle, buying from the listing agent doesn't guarantee anything except that the listing agent will make more money. If you were being sued, would you let the attorney for the other side represent you? Probably not. You need representation and a listing agent has already contracted their allegiance to the seller.

Short Sale

A transaction in which a private property owner voluntarily lists their property for sale and there is NOT enough money to pay closing costs, all loans, liens and commissions. The amount of money derived from the sale will be SHORT of full payoff. Unfortunately, though short sales may look like a good deal, they are often listed for prices lower than any reasonable lender will accept. Agents will often price sales aggressively, hoping to attract buyers or hoping the lender will temporarily lose their mind long enough to accept a lowball offer.

Confirmed short sales are transactions in which the lender has already agreed to a price and conditions. Unconfirmed short sales require long periods of time, sometimes months, to get an answer. If you are making a short sale offer, make sure your agent holds onto your good faith money till the lender accepts your offer. You don't want your money tied up and you want to remain free to make other offers. You have no responsibility owed to a short sale that does not answer quickly.

Auction

Auctions always sound exciting and sometimes can result in a good buy. Properties will typically trade for 10% to 15% below true market. BUT, and this is a big but, the auction company always tacks on a 5% to 8% fee for purchase. Make sure you account for that when making an offer.

If you have ever been to a non-profit auction you know that sometimes people get caught up in the moment and bid more than something is worth just to win. Not a good scenario if you are caught in such a circumstance. Know what it is worth, deduct whatever you will have to pay for auction premium and bid no more than that.

You will not have the same opportunity to inspect the property as you would with any other type of sale. It would be best to take someone who knows what they are doing with you when you preview pre-auction. They will not make repairs, will not do termite and will not give you your money back.

The last and best piece of advice about auctions is that they are generally properties that have already been marketed and did not sell, and there is generally a good reason. Well priced, good condition properties, even REO's, usually sell quickly. When previewing auction properties prior to an auction, have your agent ask why it didn't sell.

OH YEAH! An agent can and should represent you at the auction for the same reasons you would have them represent you in any other purchase. Don't go without expert help.

REO

REO's, also known as Foreclosure, Real Estate Owned or Corporate Owned, may be or may not be the best deal. If the lender will make lender required repairs, do section one termite and listen to reasonable offers, REO's can be a good idea. However, though they are motivated to sell they do not HAVE to sell to you.

You will have to sign their purchase addendum and it will have many scary things in it. They will not change their addendum just for you. They paid a high-priced attorney to tell them it was okay. If you love the property, hold your nose, close your eyes and sign. Otherwise the property will got to someone else. Ditto the requirement for pre-quallifying with their lender. It is not a violation of anything UNLESS THEY MAKE YOU USE THAT LENDER. Just prequal as requested and use your own lender anyway.

Cash offers, on properties that meet FHA standards, will not get you a better deal. Cash offers on properties unable to qualify for FHA MAY get you a better deal. I don't care what your favorite uncle claims, YOU WILL NOT GET IT FOR 50% OF VALUE, unless there is something severely wrong with the property. And if it's that bad, you may not want it.